MTN Nigeria Communications Plc (MTN Nigeria) has been recognised with two awards at the recently concluded National Tax Dialogue Event organised by the Federal Inland Revenue Service (FIRS).

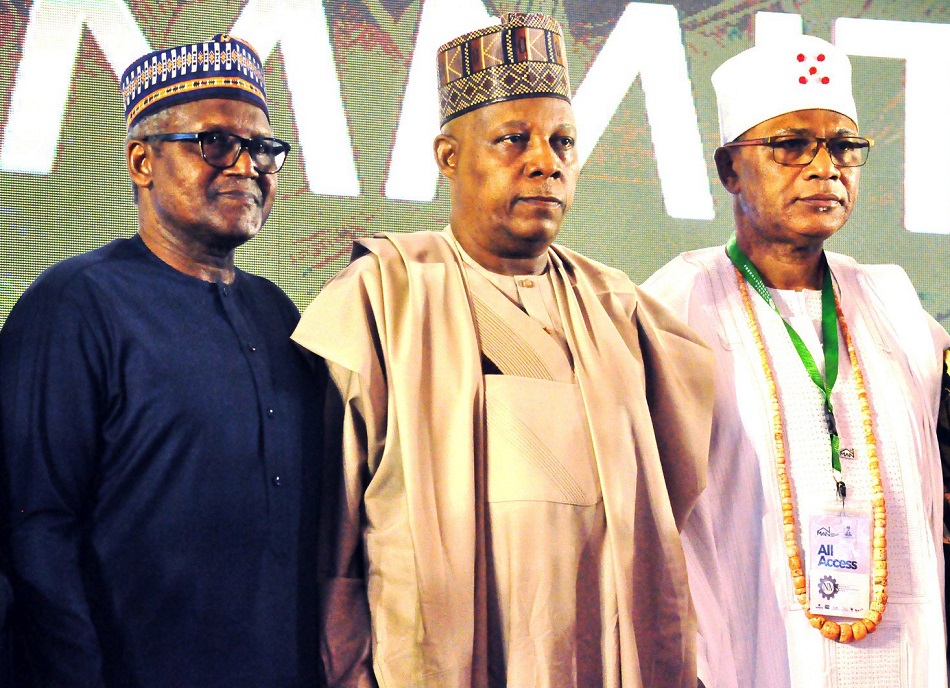

The second edition of this stakeholder engagement forum was held at the Banquet Hall, State House Presidential Villa Abuja on Tuesday, March 29, 2022, with his excellency, President Muhammadu Buhari as the special guest of honour.

MTN Nigeria was applauded as the most tax compliant organisation and a top 20 taxpayer in Nigeria for the 2021 tax year. These awards reflect MTN Nigeria’s remarkable performance in remittance of its taxes despite the challenges posed by the pandemic.

In 2021, MTN Nigeria’s total tax contribution to all government agencies including the FIRS amounted to N757.6bn while FIRS collected a total of N6.4trn tax revenue in the year. Specifically, MTN Nigeria paid a total of N618.7bn in direct and indirect taxes to the FIRS in the 2021 tax year, representing approximately 13.5% of the total FIRS collection for the year.

“I am delighted at our performance and recognition at this year’s National Tax Dialogue event. While the past 24 months have been challenging for our country and nations worldwide, we are committed to supporting the Federal Government’s ongoing Economic Growth Recovery Plan (EGRP),” said Modupe Kadri, Chief Financial Officer (CFO), who received the awards on behalf of MTN Nigeria.

“We will continue to invest heavily in network expansion with a focus on expanding access to under-served communities. We also plan to connect an additional 2,000 rural communities in 2022,” he added.

Speaking at the event, Zainab Ahmed, Minister of Finance, Budget and National Planning said the dialogue was designed to engage stakeholders in the Nigerian tax space in meaningful discourse to glean information, ideas and experience to aid policy formulation and improve the tax environment.

According to the Minister, the other tax revenue objectives are “to institutionalise a healthy tax culture among Nigerians. The right attitude towards taxation will enable every Nigerian to become a co-guardian of the tax system and the commonwealth.

In addition, this will create a participatory system of taxation whereby the taxpayers and other stakeholders understand and accept that they have an equal stake in the tax system.”

The Chairman FIRS, Muhammad Nani, thanked the President for his directive to government agencies enabling FIRS to connect to their ICT systems, noting that this singular pronouncement softened the ground for the Service to roll out its system for the seamless acquisition of data.

“We are confident that by the time all the agencies achieve 100 percent compliance with the President’s directive, Nigeria shall be the envy of other countries for tax compliance and domestic tax revenue mobilisation,” he said.

Leave a comment